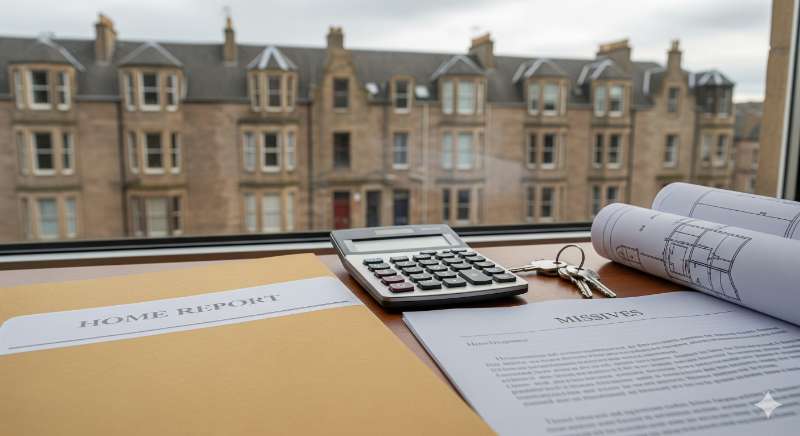

Applying generic buying strategies to the Scottish market creates significant risk for property flippers. The legal framework here is distinct. In Scotland, the agreement becomes binding early in the process, upon the "conclusion of missives."

For a flipper, this early commitment removes the option to renegotiate price based on contractor quotes or withdraw late without financial penalty. The deal analysis including accurate renovation costing, financing, and structural checks must happen before your solicitor concludes the contract.

Getting this wrong locks you into a loss-making project before you even pick up the keys, so let’s take a look further.

The Home Report: Valuation vs. Opportunity

Residential properties marketed in Scotland require a Home Report. This pack contains a Single Survey, an Energy Report, and a Property Questionnaire.

The Single Survey provides a surveyor’s valuation before a viewing takes place. This reverses the typical workflow where bidding precedes the survey.

The "Category 3" Profit Margin

Surveyors rate the condition of property elements on a scale of 1 to 3.

Category 1: No immediate action required.

Category 2: Repairs required, generally not urgent.

Category 3: Urgent repairs or replacement required.

Flipper's Insight: While retail buyers view Category 3 issues (active dry rot, structural movement, damp) as warnings, flippers view them as opportunities. Lenders frequently refuse mortgages on these properties, removing competition from homeowners. This allows cash-ready investors to negotiate significant discounts below the surveyor's valuation, securing the margin needed for a profitable flip.

The Offer Process: Notes of Interest and Closing Dates

The Scottish system uses a "blind bidding" mechanism called a Closing Date.

When multiple buyers show interest, their solicitors register a "Note of Interest." Once the selling agent receives sufficient notes, they set a Closing Date. Bidders must submit written offers by a specific deadline. No bidder sees the other offers.

The Flipper’s Strategy

Closing Dates frequently result in emotional overbidding. To flip successfully, you must buy based on the numbers, not the competition. Participating in a bidding war often erodes the profit margin.

Strategy: Avoid the Closing Date by submitting a pre-emptive offer with a strict deadline. This compels the seller to choose between a guaranteed immediate sale or the uncertainty of a future closing date.

Missives: Forming the Contract

No single contract document exists for both parties to sign. The contract forms through a series of formal letters between solicitors, termed "missives."

The Offer: The buyer's solicitor sends the formal offer.

Qualified Acceptance: The seller’s solicitor accepts, typically with conditions (qualifications).

Conclusion: Once both parties agree to all conditions in writing, missives are concluded.

Upon conclusion, the purchase becomes legally binding. Withdrawing due to funding issues or contractor advice after this point leaves the buyer liable for damages.

Risk Mitigation: Never instruct your solicitor to conclude missives until your bridge finance is fully approved and your renovation team has confirmed the scope of works.

Taxation: LBTT and the 8% ADS

Stamp Duty Land Tax (SDLT) does not apply in Scotland. The applicable tax is Land and Buildings Transaction Tax (LBTT).

Flippers must budget for the Additional Dwelling Supplement (ADS). As of December 2024, the tax rate on second homes and investment properties rose from 6% to 8%.

This tax applies to the entire purchase price for any additional property valued over £40,000.

Flipper's Calculation:

Purchase Price: £100,000

LBTT (Standard): £0 (Below the £145k threshold)

ADS (8%): £8,000

Total Tax Liability: £8,000

This £8,000 is a direct reduction of your net profit. It is an upfront cash cost that cannot be added to a standard residential mortgage. It must be factored into your Return on Investment (ROI) calculations immediately.

Financing: Standard Securities and Bridging

High street lenders often decline properties deemed "uninhabitable" (missing kitchens or bathrooms). Investors frequently use bridging finance for these projects.

In Scotland, the lender secures the loan against the property using a Standard Security. This functions similarly to a mortgage deed but involves specific Scottish registration requirements. The legal fees for setting up a Standard Security are often higher than standard conveyancing due to the additional work required by the solicitor to satisfy the lender's requirements.

Date of Entry and Renovation Speed

The Date of Entry is the settlement day. The buyer transfers the funds, and the seller releases the keys.

Accelerating the Flip: Time is money. Investors can sometimes negotiate early access under a "license to occupy" (e.g., one week before settlement) to strip out the property. While solicitors often advise sellers against this, securing early access can shave weeks off your renovation timeline, reducing holding costs and increasing ROI.

Frequently Asked Questions

What is the Home Report in Scotland? The Home Report is a mandatory document in Scotland that provides an independent assessment of a property’s market value, condition, and energy efficiency. It is required for informed buying decisions and allows flippers to assess value before viewing.

What taxes should I consider when purchasing a property in Scotland? You need to account for LBTT (Land and Buildings Transaction Tax) and ADS (Additional Dwelling Supplement). The ADS currently stands at 8% for second homes or buy-to-let properties and is payable on the full purchase price if over £40,000.

How do I calculate profit from a property flip? Subtract the total purchase costs (including legal fees and ADS), refurbishment costs, and selling fees from the final sale price. Aim for at least a 20% Return on Investment (ROI) to validate the risk.

Why is the refurb budget so important? An accurate refurb budget prevents overspending, the most common cause of failed flips. Always secure quotes from professionals and include a contingency fund (typically 10-15%) for unexpected structural issues.

How can I avoid common mistakes when flipping property in Scotland? Factor in all acquisition costs (especially the 8% ADS), use fixed-price builder’s quotes rather than estimates, and verify that your End Value (GDV) aligns with sold comparables in the area. Do not rely solely on the estate agent's valuation.

Conclusion

If you are considering your first property flip or require guidance on a project, contact Stewart Thomson Property. I offer practical advice and mentorship to help you make better decisions. Let’s discuss how I can assist with your investment goals.